|

Sadly, so many of these

items were sold in 1979 and the early 1980's. Prices were very different

in those days, but even then, the question of value was unpredictable too,

although it is even more so these days!

Quite often a few good pieces failed to

reach the low reserve figures and did not sell, whilst the odd one would sell

for more than ten times the carefully considered estimate!

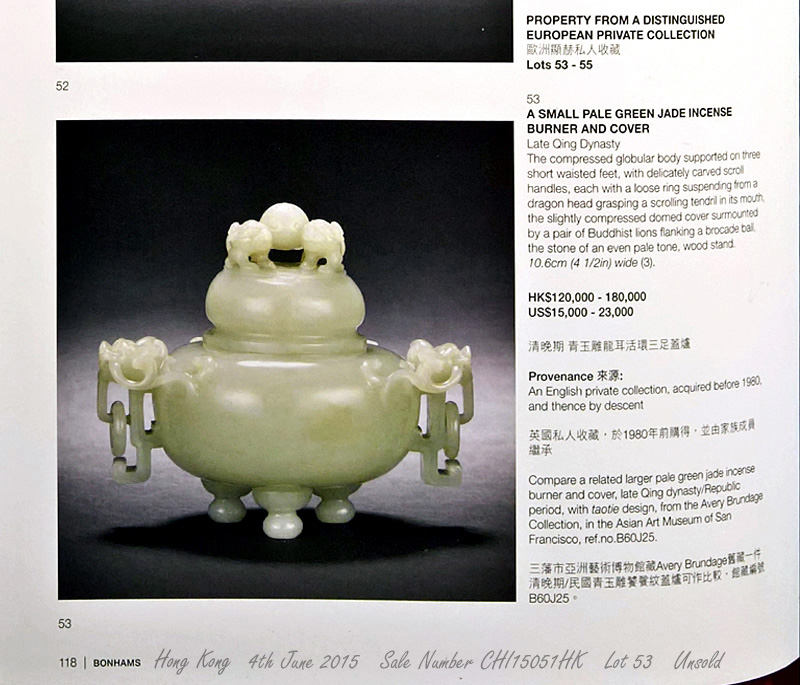

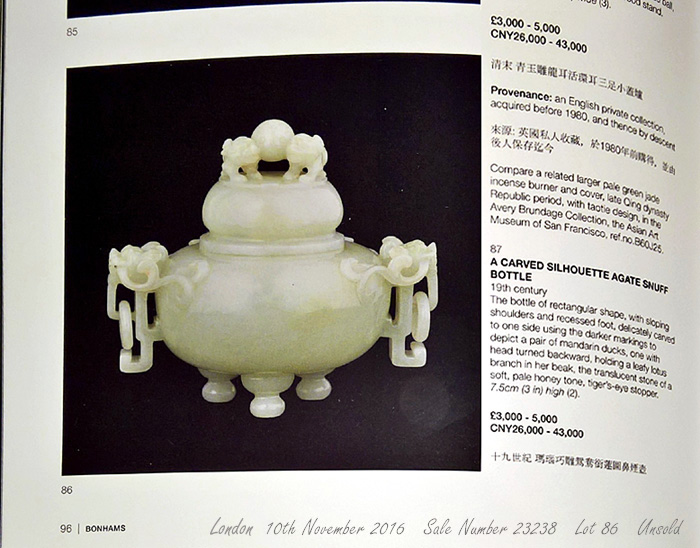

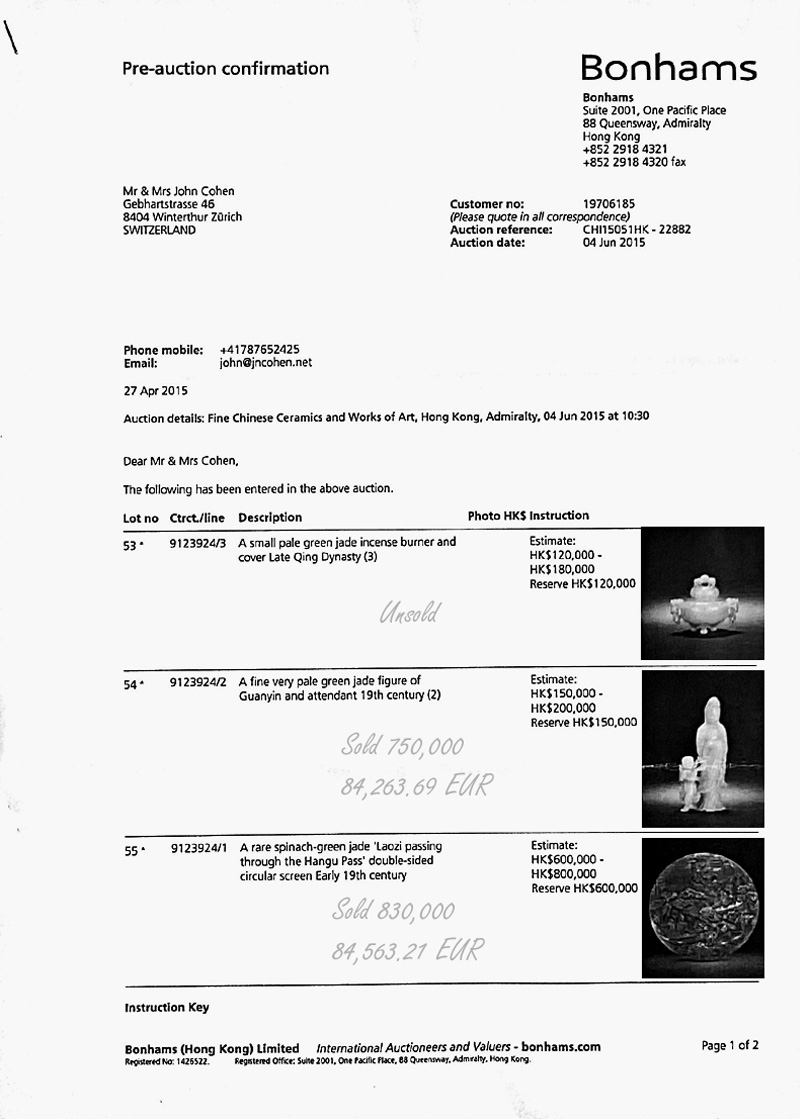

For example in

2015, I had given a fine Jade incense burner to Bonhams to sell in Hong Kong,

as they had agreed to a reserve figure of 20,000 Euros. But it failed to

sell, so it was agreed to try again in London about a year later, only

this time the reserve was agreed at only 3,000 Euros, in the belief that such

a low estimate was more likely to attract more buyers and so the resulting

bidding would still then achieve a good result. It didn't work out, once

again it failed to sell! The quality of this piece is not in question, it is just one

that got overlooked, or there was just no interested buyer at the auction. I am so glad that it did not sell, for

a little over the

reserve, which was a risk, as I far prefer to own it than to receive so little

for it.

In the same auction we sold a figure of Quanyin and

attendant for HK$ 750,000 amazing when the high estimate was HK$ 200,000!

There are so many changes and fashions that influence the prices,

for example, consider the question of colour. When we started collecting, a

fine piece that was spinach green, was highly sought after and that colour would certainly add

extra value. But now white is deemed far more desirable and the dark green is

just not selling so easily. This can change again, but who knows?

Generally, the auction catalogue estimates are often regarded as having been far too low.

Because once the bidding results are known, the sold item prices are often much more.

But really it is impossible to predict with any certainty what price will be achieved. In the end the only true value is simply

dependant on how much the buyer, at the time, is prepared to pay. So before any of them are actually sold, the value can only remain as a guess,

which (with hindsight) so often turns out to have been the wrong one!

By wrong, I mean that these antiques can so easily be over valued, or under valued by the experts and not by just a small amount!

|

Having looked at some other old catalogues I discovered that in 1987 my Father decided to sell several of his Jade items at

Sotheby's 'Chinese Decorative Arts, Export Porcelain and Snuff Bottles' and amongst them is illustrated a yellow jade Ewer (lot 308) wrongly described as

19th Century and unsold for '350 that has now been identified as 18th century and Imperial! Strangely a jade white elephant (lot 319), was bid up far more

than the ewer, but it was still unsold, as it too failed to reach the low reserve.

I recognised and remember lots: 303, 306, 307, 308, 309, 310, 311, 314, 315, 319, 320, 340, 341 and 342.

All of these failed to reach the low reserves that were all very reasonable at the time.

Proving just how valuations are so difficult.

As a collector I ignored the estimates and relied on setting a price based simply

on how much I wanted each item, I made a note of my maximum bid, but whilst attending the auction I have to confess, on the odd occasion, even I did bid a

little more than I had intended. My method of setting a value in those days, was mainly based on what I had found available at the dealers and the

most recent auction sale results, which I used as a means of comparison.

But these days such an approach is far more dangerous.

I wrote dangerous, because apart from the modern copies (not so easily

recognised) that have caused provenance to be so important, there have

been such a large number of record breaking prices paid, that are so much

higher than seems realistic. These might prove to be poor investments

whenever they are offered for sale again. But the future is not ours to

know!

|